Breakout Startups #34- smallcase

The Startup making waves in the Indian Investing Scene

Hi,

How’s it going? This newsletter edition comes after a long unscheduled break. Last month has not been the most productive for me especially with regards to working. Let’s see how it goes :)

Also, I have an important announcement to make. Now onwards, I will be joining Keeping Up With India, another Substack publication by my friends Anmol Maini & Vedica Kant to write long-form content on Indian Startups. My first piece will be focused on how Cricket🏏 is the Ultimate User Acquisition Strategy in India.

Coming to our business, today, we are going to be talking about Smallcase. Founded in 2015 by Vasanth Kamath, Anugrah Shrivastava, and Rohan Gupta -- Smallcase operates a platform for individual investors to invest in ready-made portfolios of stocks and exchange-traded funds (ETFs) -- which it calls “smallcases” -- with their existing Demat accounts.

Smallcases vs Mutual Funds

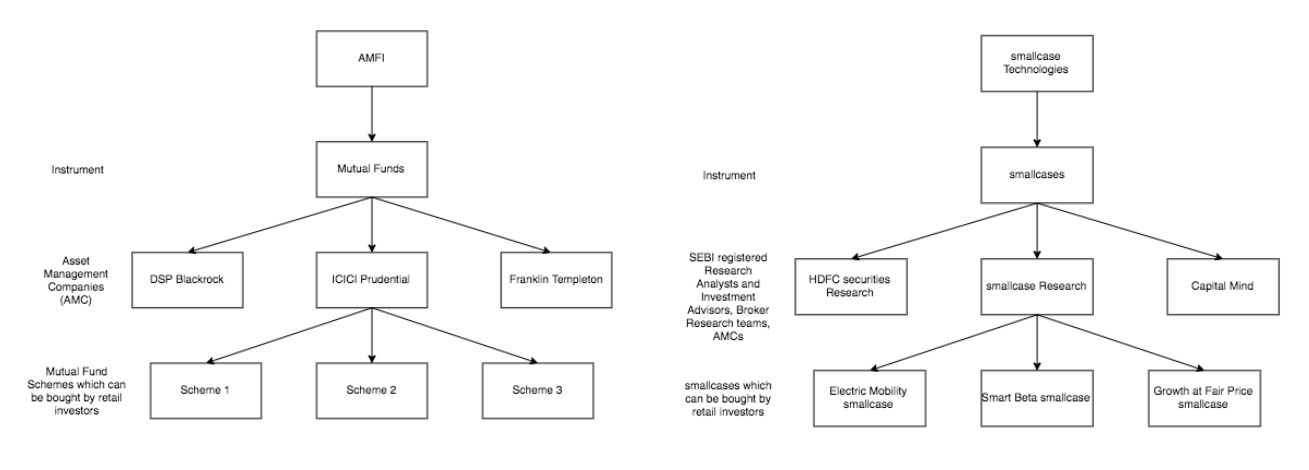

Before getting into detail about Smallcase, let me tell you the difference between Smallcases & Mutual Funds. Smallcases are portfolios of stocks or exchange-traded funds (ETFs) that are selected, created and weighted to reflect an idea, theme or strategy. While mutual fund portfolios are also built around themes, an investor in smallcases holds shares in their portfolio as against units.

As Vasanth Kamath, CEO of smallcase, the company we are going to be discussing says, “The idea is to get retail investors to take a portfolio-based approach while investing in stocks, versus thinking about individual stocks”.

Product

Many people know Smallcase as a platform which lets one invest in a portfolio of stocks or exchange-traded funds (ETFs) or even create customized portfolios. These portfolios can be sectoral, thematic, large-cap stocks-oriented or give exposure to various assets via ETFs aligned with the chosen asset allocation strategy.

The company has also tied up with eight brokerages—Zerodha, HDFC Securities, Kotak Securities, IIFL Securities, 5paisa, Edelweiss, Axis Direct and Alice Blue—which provide investors smallcases on their own websites.

However, this is not the only product the company has. It has 3 more products in its suite which are:

smallcase Publisher- enables any SEBI-registered professional to create their own smallcase. Earlier, all smallcases were created by Smallcase in-house research team. Today, a number of broker research teams, independent research analysts and investment advisors create their own smallcases. Interestingly, a couple of AMCs are creating smallcases using their own ETFs. FYI, AMCs are the ones who create mutual fund schemes; smallcases in a way compete with mutual funds.

smallcase Gateway- enables stock & ETF transactions on any website/app. It's like a payment gateway, but for stocks. With this, Apps will be able to transact through any of the 9 brokers integrated. These brokers combined account for 60% of retail investors in India😮

You can read more about smallcase Gateway here.

Tickertape- is one of the most comprehensive sources of data for research and analysis of stocks. It is currently used by over 1 Million investors in India. Being built as an independent product, this is something which we will hear a lot about in the coming days.

Traction

Launched in 2016, the platform has garnered a total user base of 8 lakh investors who have transacted over Rs 3,000 crore in small cases. Not just this, the number of smallcases on the platform has risen 15% YoY for the past 3 years. The average investment amount on the platform stands at INR 1.5 Lakhs over 24 months which indicates people’s willingness to stick with the product in the long run.

In June 2018, the total number of users was 1.5 lakhs. The company was a part of Rainmatter, a Fintech startup accelerator run by India’s No. 1 Stock Broker, Zerodha. The accelerator grants its startups access to ~1.5 million already strong client base of the company to showcase and validate any product instantly.

Zerodha is a beast in the Indian Fintech community and has helped several startups validate their concept and launch(more on it in the Investors Section below).

One more key reason behind this phenomenal growth rate is the buzz product has generated across its user community.

Market Landscape

Smallcase is playing in one of the most competitive markets out there with the number of competitors growing almost every quarter. However, one thing which gives the company a unique position with its growing userbase and increasingly good branding with its user community.

SAMCO- lets you invest in an expert-selected basket of stocks, curated based on 25 intelligent stock rating parameters.

Fyers- have launched Stock Baskets recently.

Stockal- allows people to invest in US Markets. They recently launched a stock basket for US Markets.

Kristal.ai- offers ETF baskets of US Markets.

Similarly, ICICI Securities & Aditya Birla Capital recently launched Stock Baskets however that seems more like an additional feature and not the main focus for the company.

The room for growth of smallcases in India is immense. To get an idea, Mutual fund penetration in India is much lower than the world average and many other developed economies. While the US has its AUM more than the country’s GDP at 103 per cent, it is only 11 per cent in India. The world average is 55 per cent. (Source)

The number is even less for stock investing which Smallcase enables. The investing appetite of Millennials India is only going to grow in future and startups such as Smallcase will be the catalysts of the movement.

Funding

So far, the company has raised $8M(& some undisclosed amount) in Funding from Sequoia India, Blume Ventures & Rainmatter Fund.

The company was incubated at Rainmatter, a fintech incubator by Zerodha.

Team

Currently, Smallcase has over 90 employees and is growing rapidly both on the team size front and the number of investments made on the platform.

Road Ahead

Talking about his vision for the company in an interview, Vasanth says,

Going forward, we would like to build an ecosystem around smallcases. We have the largest brokerages offering smallcases to their clients. We are now working on enabling advisory platforms, wealth managers to advise on smallcases as they do with mutual funds. The average age of our investors on smallcase is 28. Millennials usually challenge the status quo and think first principles, making our job easier to convince them to get started with smallcases. Our focus is to continue developing beautiful, easy products for millennials. So an investing experience for them is similar to booking a cab or shopping online. We are also working towards building a brand that is relatable to millennials.

The company has plans to become a Full Stack (passive)Investment platform millennials with services for every stakeholder ranging from investors to MF Managers to investment advisors.

To better understand this, here’s a graphic which I was able to secure from the team👇

Eventually, the company wants smallcases to take the same role as Mutual Funds in the current investment scene with its SEBI-vetted advisors curating these smallcases on the platform. (You can view a clearer version of the image here)

BONUS TWEET

If you liked reading this edition of Breakout Startups, share it on Twitter😀

See you next week. Signing off, @ankitkr0 :)

This was great! Love the social & thematic approach to portfolio construction; they just got a new customer!

Great piece Ankit! I had a faint idea about it, but this clears so many aspects!