Hi everyone,

Ankit here. I am sorry for sending this a day later, it required some more research on my end.

Coming to it, I hope y’all are social distancing and taking care of yourselves. It’s Day 14 (or 15, I have lost count honestly) of lockdown in India and things are showing no signs of slowing down. I would urge all of you to avoid going out as much as you can.

However, the quarantine has led to a bunch of cool things happening as well. People are doing most of the activities online, one of my friends, Aditya Mohanty, started a dope project called GrabChai, where you can hang with interesting folks over tea. Highly recommend signing up :)

In lieu of such projects, Zoom is exhibiting an astronomical growth in the number of users for the products. Recently, it announced that it went from 10M DAU to 200M DAU in less than 90 days😮

Moving on from Zoom stuff, today, we are talking about an Indian startup called BharatPe, which helps offline merchants accept digital payments.

About BharatPe

Started in April 2018 in Delhi as a way for Merchants to collect payments online for FREE, BharaPe has become a behemoth in the Indian Fintech scene.

It wouldn’t be wrong to say that company is basically the distribution engine which enabled merchants to adopt UPI all over the country.

Origin Story

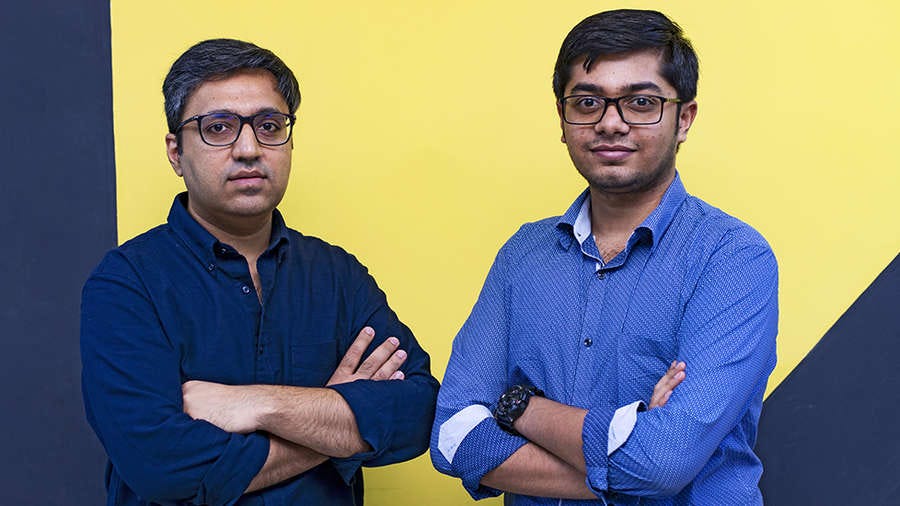

Ashneer Grover met up with Shaswat Nakrani, then a student at IIT Delhi, in the campus thinking Shashwat’s startup could be a good angel investment opportunity for the fintech veteran. But after the first meeting, Ashneer became convinced that this is how UPI will become a force across India and ended up joining the team fulltime.

Come to today, BharatPe commands a 50% Market share in Offline UPI Payments Category.

Growth Story

India has already emerged as the second-largest internet market, with 560 million users, but much of the country remains offline. Among those outside of the reach of the internet are merchants running small businesses, such as a tea stall or a Kirana shop near your house. Bringing these merchants online is a key factor in growing India’s digital economy and this is what BharatPe enables. It relies on QR codes that support government-backed UPI payments infrastructure.

To establish its distribution prowess, the first thing which the company did was hire over 3000 on-field agents to onboard merchants onto its apps. Going Offline is the fastest way to scale in India and BharatPe has done it really well. Each of the on-field agent is paid a monthly salary of $350-$400 which takes down the CAC for the company to ₹200 or $3 which is very impressive for a 3-year-old company.

Currently, the startup has amassed over 3 million merchants in 30 Indian cities & is aiming to double the number by March next year.

In a masterstroke, the company roped in Salman Khan, one of the most recognizable faces in India which struck a tone with merchants across the country.

If you are looking to dive more into this, Pranav from Twilio has written a great thread on how BharatPe captured 50% of Indian Offline UPI Merchant Market.

One of the most interesting things which I got to learn from this thread is that the company’s name consisting of BharatPe sometimes creates an image that BharatPe is an initiative by the government of India.

BharatPe Loan Business

Given that the company doesn’t make any money off its UPI Payment service, where does it actually make money?

BharatPe has a rapidly growing lending business. In the funding announcement two months ago, the company said that it has disbursed about $14 million “short-term” loans to over 20,000 merchants in the last seven months. The startup despite being less than 3 years old has been able to win when it comes to establishing distribution and trust with vendors. These two factors are very crucial when it comes to establishing credibility as a lender especially in a low trust society such as India.

Competiton

BharatPe is just one of the many startups trying to win the market. If you go to a shop in any of the metro cities, this will be a common sight👇

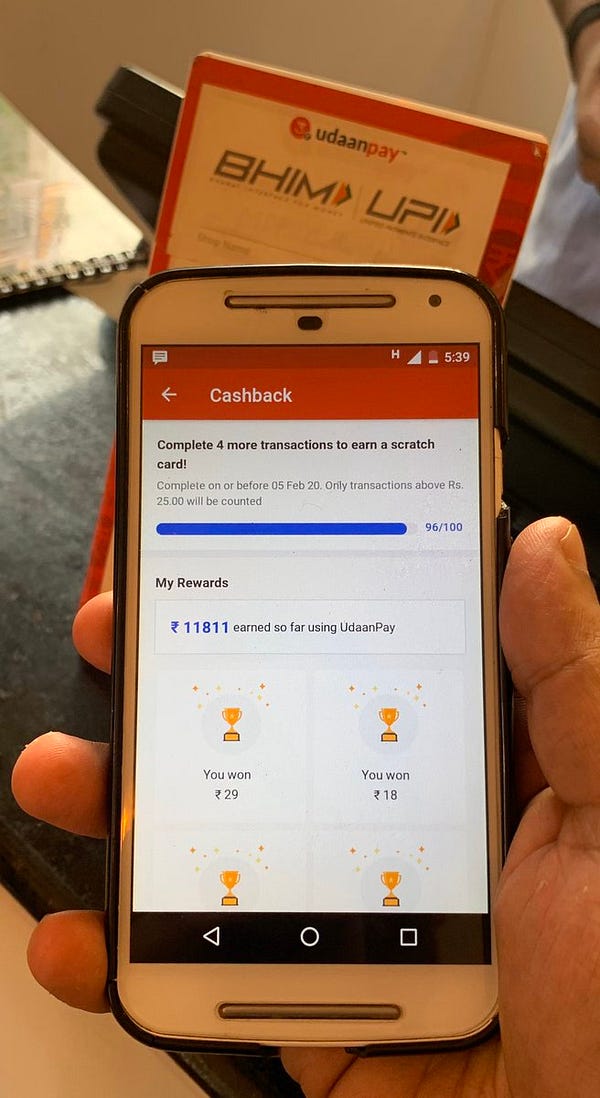

The key thing here to understand is that all these companies are luring in merchants through cashbacks. One of the startups, Udaan, recently ventured into this segment with this segment and the only reason merchants prefer Udaan above others is high cashback.

For example- This is vendor cashback to a shop in HSR Layout, Bangalore. Moreover, this shop earned ₹600 in the coming 4 days.

Everybody wants to get in on acquiring these merchants and service them. This is how the competition looks like right now👇

And this is just the tip of the iceberg, many startups such as Khatabook, OkCredit who already have an existing relationship with offline merchants can venture into the market.

Team

Ashneer Grover- Founder & CEO, BharatPe. Payments & Fintech Veteran who has worked with several companies across India & USA.

Shashvat Nakrani- Founder & CTO, BharatPe. Dropped out of IIT Delhi.

Funding

To date, BharatPe has raised a total of $141.5M in funding over 4 rounds.

In the latest round, BharatPe closed a Series C of $75 Million led by Ribbit Capital which valued the company over $400 Million.

Prior to this, the company had raised a Series B of $50M & Series A of $15.5M from the reputed investors such as Steadview Capital and Insight Partners.

——————————————————————————————————————

BharatPe has financial ammunition and the first-mover advantage to take on its heavily funded competitors. It will be interesting to see how this market evolves. My theory is that the company which will win will essentially end up offering everything from insurance to loans for these merchants. That way, one can present a value proposition to act as a financial manager for these merchants which will help them in everything ranging to invoicing to banking to both short & long term loans.

BUT,

——————————————————————————————————————

That’s it for today. See you on Sunday.